The United States economy has weathered countless panics, bubbles, and recessions throughout its history, typically recovering with a vengeance on the way to achieving new heights. One and only one downturn turned into a Great Depression. So far.

Countless scholars have studied exactly how the federal government managed to turn a stock market crash and cyclical recession into a fifteen year nightmare. Only incorrigible ideologues persist in spouting the idea that greed and selfishness caused the Great Depression. After all, these are eternal features of the human condition.

Thinking economists generally blame a combination of the Federal Reserve’s failure to maintain a steady price level and Congress’s insistence on destroying global trade with its protectionist Smoot-Hawley tariffs. Debate continues on the degree to which FDR’s interference in the economy helped or made things worse, but the undeniable fact remains that the country didn’t get back on track until all the economic controls loaded onto businesses were lifted at the end of World War II.

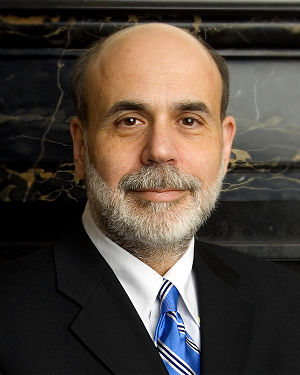

Ben Bernanke devoted his professional life to understanding these failures. Destiny put him at the helm of the Federal Reserve when a real estate bubble fueled by easy money, collapsed lending standards, rash derivatives gambling, and a bipartisan bailout upended the world’s financial system. As the economy teetered at the edge of the abyss Helicopter Ben flew into action, flooding the planet with liquidity determined to smother any hint of demon deflation under mountains of fresh greenbacks.

Hurrah, it worked! Prices are going up, slowly at the moment, but with every indication that we will soon be longing for the days when inflation was only in the single digits. Meanwhile debate continues on whether President Obama’s czar-driven interference in the economy is increasing or decreasing the rate at which things are getting worse.

So, Ben, now that you have saved us from the horror of cheaper stuff why isn’t the economy bouncing back like it has after every other recession?

Cue deer in headlights.

Come on, mumble some sphinx-like inanities to reassure us. It worked for your predecessor. “We don’t have a precise read on why this slower pace of growth is persisting” is not going to cut it. Grab a thesaurus and pull out whatever comes after “temporary factors” and “persistent headwinds.”

Don’t you realize that supporting the illusion that the Chairman of the Federal Reserve knows what the hell he is doing is central to maintaining investor confidence? Do you understand how paralyzed with fear your countrymen will become if they realize that all you economics professors in Washington are merely passengers on a runaway train? What will people make of your promises to know exactly when to soak up all this excess liquidity before it drowns us if it becomes obvious that you haven’t got a clue what is going on or why?

Ben, you have a sacred obligation to continue faking it. Nobody will think less of you if you just brazen it out. Follow the example of the president, go buy yourself a teleprompter and blame everything on the last guy. With a little luck your term in office will be over before voters figure out that turning over the economy to people who have never worked a real job a day in their lives is insane. This is not to belittle the value of waiting tables at South of the Border any more than discounting the lessons one learns as a community organizer. But asking unaccountable bureaucrats to steer a national economy without ever having contributed to it is like asking the Pope to train sex therapists.

We all know that the Federal Reserve rests on a shared illusion. In what other industry can the biggest suppliers collude and fix prices with impunity? Which other businesses can always count on helping themselves to “liquidity” whenever they get themselves in a pickle? Keeping the masses believing that some guy in Washington sets interest rates with a wave of his magic wand only works if all the co-conspirators play along. A fiat currency is only as good as the inordinate faith people place in it.

Ben, maintaining this faith is your sacred obligation. No journalist will call you a liar if your prognostications turn out to be dead wrong; after all there is never any accountability in Washington. But everyone will blame you if you start to look the fool. You are safe for the moment as your boss can’t turn you into a scapegoat without admitting that he’s equally clueless. But if we’re sitting here in the summer of 2012 with 10% unemployment, 10% inflation, and negative economic growth who do you think will be the first to walk the plank?

source: forbes.com

please give me comments thanks

6:44 AM

6:44 AM

admin

admin

Posted in:

Posted in:

0 comments:

Post a Comment