Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

If the IPO Party left you behind last month, keep XOOM on your radar because this débutant has and will continue to revolutionize its industry.

Xoom, headquartered in San Francisco, is a leader and pioneer in the consumer-to-consumer international money transfer industry, which offers a secure, fast, and inexpensive way to send money from our website to friends and family in these countries. With over 750,000 active customers and a usability platform ranging from your desktop to their mobile application, this company has experienced a multi-year 60% revenue growth and a notable margin expansion despite its non-profitable history. Since January 2008, $6.6 billion has been sent using the company's platform, $3.2 billion of which were sent in 2012.

XOOM commenced on the NASDAQ Global Market on Friday, February 15, 2013 and quickly soared almost 60% after its offer price of $16. The stock opened at $23.20, closing at $25.49 on its first day of trading. It offered about 20% of its 32.7M outstanding shares, increasing the company's capital base by $77M. Consequently a large selloff and the dilutive effects of the aforementioned capital raising led to negative investor sentiment and a drop in the stock price.

Chart and Price Details (Click on Chart for Source)

Date

|

Close/Last

|

Volume

|

3/25/2013

|

23.02

|

74,367

|

3/22/2013

|

23.14

|

45,878

|

3/21/2013

|

23.01

|

38,634

|

3/20/2013

|

23.07

|

50,946

|

3/19/2013

|

22.82

|

58,327

|

3/18/2013

|

22.49

|

114,468

|

3/15/2013

|

23.42

|

121,720

|

3/14/2013

|

23.51

|

15,647

|

3/13/2013

|

23.55

|

54,724

|

3/12/2013

|

23.26

|

152,177

|

3/11/2013

|

23.85

|

81,244

|

3/8/2013

|

23.1

|

71,226

|

3/7/2013

|

23.16

|

49,652

|

3/6/2013

|

23.81

|

30,874

|

3/5/2013

|

23.6

|

50,413

|

3/4/2013

|

24.49

|

154,119

|

3/1/2013

|

22.32

|

36,598

|

2/28/2013

|

21.26

|

42,000

|

2/27/2013

|

21.27

|

93,097

|

2/26/2013

|

21.32

|

89,876

|

2/25/2013

|

20.66

|

102,341

|

2/22/2013

|

20.34

|

213,363

|

2/21/2013

|

21

|

563,026

|

2/20/2013

|

22.1

|

443,962

|

2/19/2013

|

23.9

|

916,068

|

2/15/2013

|

25.49

|

6,212,474

|

Five-Year Trend

Over the last 5 years, Xoom's revenue has grown exponentially with a YoY average growth of about 60%. Although it has yet to report profits, the company's income is steadily moving out of the red at an average rate of 15% per year. The funds raised by the secondary offer should catapult Xoom into profitability as it plans to use the proceeds for working capital and general corporate purposes with the possibility of buying complementary businesses, products or technologies.

*figures are in thousands USD

Investor Confidence & Competition

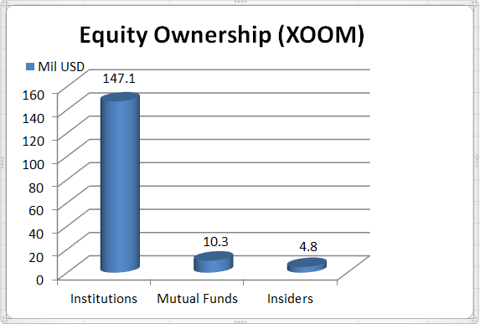

Premier institutional investors such as T Rowe Price, Fidelity, BlackRock & Charles Schwab have granted Xoom a much needed vote of confidence as they skew the table (see below) in equity ownership with over $147M. This helps XOOM place itself in the same list as its two most sizable competitors: Western Union Company (WU) & MoneyGram International (MGI).

Overwhelming ownership interest has fueled shareholder activity and has been the catalyst for the mobile money transfer industry to gain pace. Xoom is fairly new when compared to Western Union and MoneyGram; the latter trump Xoom's figures and market capitalization of only $731M (WU: 8,429M & MGI: 1,017M). The company has a small fraction of the money transfer business that is estimated to reach over $685B by 2015, and it MUST take market share in order to grow fast. It seems that this is already the case as Xoom is reducing the projected earnings of both its competitors (as detailed in Benedict Tubuo's article) with the introduction of its new technologies: StatusTrak & POWR. Standing for "Pay Only When Received," it is a breakthrough initiative that gives customers assurance that Xoom will not withdraw a dime from their bank accounts until the money is received by their loved ones. Julian King, Xoom's Senior Vice President of Marketing and Corporate Development said, "With POWR, we show once again how Xoom has revolutionized money transfers." StatusTrak is a new tracking center that provides four ways of tracking a customer's transfer:

- Test Updates

- Email Updates

- 24/7 Phone Support

- Web & Mobile Access

Conclusion

With a client-focused business model constantly seeking new technologies that provide efficient ways to service its customers, Xoom definitely has the competitive edge in the once unglamorous world of Money Transfers. If it could expand its services to domestic (Person-to-Person & small business) money transfers, such as Citi's Popmoney, Xoom can one day surpass the likes of its competition. In regards to where the stock will move in the near future, my inclination is bullish for the stock overall, pending a still-awaited pullback. This disagrees slightly with strong ratings of Baird, Needham & Raymond James, but I believe that timing is key. Currently trading at $22.96 and a healthy 9.2x 2012 sales, I estimate that after a pullback testing the $20-21 range, Xoom will reach a target price of about $29 with a promising future.

please give me comments thanks

6:38 AM

6:38 AM

admin

admin

0 comments:

Post a Comment