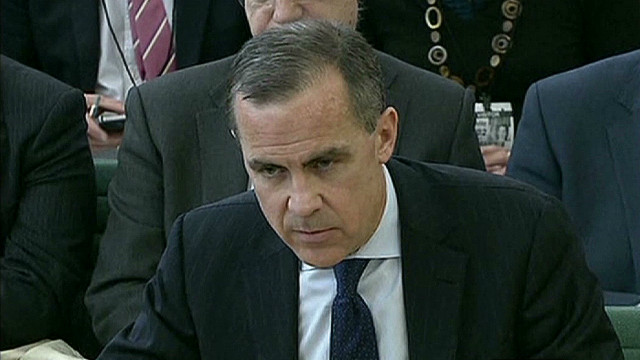

Hong Kong (CNN) -- Mark Carney, current Bank of Canada governor and incoming governor for the Bank of England, faced questioning by UK parliament members on how he would lead as the first foreigner to helm Britain's central bank. Carney will succeed Mervyn King at the BOE on July 1, 2013.

New government data shows that Britain risks a third recession since the 2008 financial crisis. Gross domestic product for the UK fell by 0.3% in the fourth quarter, weaker than economists' expectations and adding pressure on London to ease its drive for austerity.

In his first big meeting with British MPs Thursday, Carney appeared to keep from rippling the trans-Atlantic waters.

"I was impressed. I have to say he was clearly a class act," said British MP John Thurso to CNN's Richard Quest. Thurso added that Carney navigated concerns of an overreach of powers as the new BOE boss. "The obvious one was what he could do in statute and what he couldn't do. And he very clearly replied that he would follow the statute. So he was good."

Carney told British MPs the country might need to keep monetary stimulus unchanged for a certain period of time in order to raise business and household confidence,according to Reuters. Through January, the Bank of Canada has held its benchmark interest rate at 1% 19 times in a row in the hopes of spurring growth.

In London, Carney made clear he knew of his existing range of weapons to succeed, including quantitative easing and bank rate changes. Still, he said he would like to develop new tools if needed and engage in collaborative debate on the best way to bring Britain to a recovery.

"I think he made clear to us that it's not his job to take...risks," said Thurso. "It's the job of the bank to have the debate or to lead the debate, but ultimately it's the job for those of us in politics, in Parliament, the chancellor (of the Exchequer George Osbourne) to decide what the remit is. And what he (Carney) said was, 'Tell us what the bounds of our remit are, and we will act within it.'"

"The great thing about the BOE is that it's got a lot of people who are academic and who are very evidence-driven and evidence-led," added Thurso. "If you marry that to a bank -- which has always been very academic in its thinking and in evidence-based conclusion -- we might end up with a really good marriage, and I'm going to be hopeful until proved otherwise."

sourceplease give me comments thanks

6:42 PM

6:42 PM

admin

admin

0 comments:

Post a Comment